Introduction

For many businesses, maintaining masterminds is a brain challenge. Whether you own a small business, a start-up, or a solid company, anticipating high-yield profits can produce huge profits. This is where Invoice financing companies come into play. This campaign has presented a financial solution which has given the remaining residence benefits to the businesses till the working capital.

In this article, we will discuss the best antique financing companies, how they work, the benefits of financing, and how to make the right decision for your business. We will also discuss how businesses can benefit from factoring and the use of finance, as well as meaningful financing solutions such as Ford Finance, Nissan Finance, driveway Finance, kia Finance, and small business companies that do financing. Furthurmore,for those who are looking for solutions to the problems of freedom from debt, we have received the right to provide financial assistance through the process of logging in to Above Lending Beyond Finance or Beyond Finance app.

What is invoice financing?

Invoice financing is a financial solution where businesses sell their personal property to customers in exchange for a loan. Instead of waiting for 30, 60, or 90 days to pay the buyer, businesses can collect the money in advance so they can meet their expenses and expand their operations without any late.

Invoice Discounting

Short list of investment: While using investment funding as collateral for loans, businesses maintain control over the decisions of investors.

While companies such as Beyond Finance Atlanta GA and Beyond Finance are providing financial solutions, businesses can still access more structured investment funding solutions by making sure of this fact.

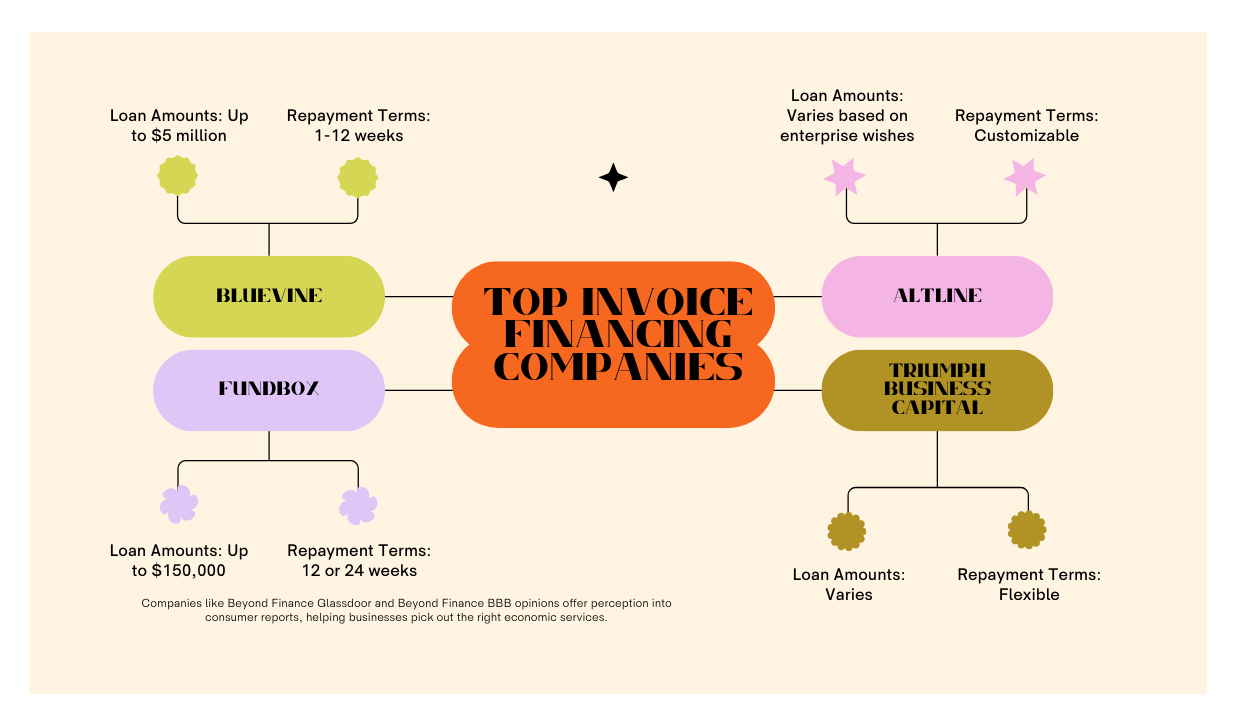

top invoice financing companies

BlueVine

Best for: Small groups wanting quick investment.

Loan Amounts: Up to $5 million

Advance Rate: Up to 90%

Repayment Terms: 1-12 weeks

Benefits: Fast approval system, competitive charges, and a consumer-pleasant platform.

2. Fundbox

Best for: Startups and businesses with fluctuating coins glide.

Loan Amounts: Up to $150,000

Advance Rate: Up to a hundred%

Repayment Terms: 12 or 24 weeks

Benefits: No minimal credit score score required, computerized approval procedure, and transparent expenses.

3. AltLINE

Best for: Businesses searching for financial institution-backed bill factoring.

Loan Amounts: Varies based on enterprise wishes

Advance Rate: 80%-90%

Repayment Terms: Customizable

Benefits: Low fees, backed by using a reputable bank, and best for B2B companies.

4. Triumph Business Capital

Best for: Freight and transportation companies.

Loan Amounts: Varies

Advance Rate: Up to ninety%

Repayment Terms: Flexible

Benefits: Industry-precise financing, aggressive fees, and on line account management.

5. Riviera Finance

Best for: Companies needing dependable, non-recourse factoring.

Loan Amounts: Up to $2 million

Advance Rate: Up to 95%

Repayment Terms: Varies

Benefits: No lengthy-term contracts, rapid investment, and nationwide service.

Companies like Beyond Finance Glassdoor and Beyond Finance BBB opinions offer perception into consumer reports, helping businesses pick out the right economic services.

How to Choose the Right Invoice Financing Company

When choosing an bill financing employer, bear in mind these key factors:

Advance Rates: Higher increase prices suggest greater instant coins drift.

Fees & Costs: Look for transparent pricing and keep away from hidden charges.

Customer Service: Read reviews on Beyond Finance customer service number to gauge guide first-class.

Application Process: Choose groups with a fast and smooth application process, specifically if you need pressing funding.

Industry Specialization: Some companies focus on certain industries like roofing corporations that finance or consumer financing for contractors.

Alternative Financing Options

Apart from invoice financing, companies can also don’t forget these financial solutions:

Factoring and Finance

Factoring is a great alternative to traditional loans, offering corporations with immediate coins by means of selling invoices to a 3rd-celebration organization.

Ford Finance, Nissan Finance, Kia Finance, Driveway Finance

Auto financing alternatives along with Ford Finance, Nissan Finance, and Kia Finance can help enterprise owners buy or hire agency motors with bendy repayment plans.

Roofing Companies That Finance

Many roofing businesses offer financing plans, making it less complicated for groups and house owners to come up with the money for roof upkeep or replacements without large prematurely expenses.

Financed Car Insurance Requirements

If you’re financing a automobile in your enterprise, knowledge financed vehicle coverage requirements is vital. Most lenders require complete coverage coverage to guard their investment.

Beyond Finance Remote Jobs & Beyond Finance Assessment Answers

Beyond Finance also gives employment possibilities, together with Beyond Finance far off jobs. If you’re considering operating with this economic service company, checking Beyond Finance assessment answers can help you put together for hiring critiques.

Conclusion

Choosing the proper bill financing organization can provide corporations with the working capital they need to preserve constant operations and grow. Whether you choose invoice factoring, bill discounting, or alternative finance answers, having access to immediate cash flow may be a sport changer for your business.

Before you make a decision, evaluate exclusive invoice financing organizations, check evaluations, and examine the phrases that exceptional suit your economic desires. Whether you’re in contractor financing, automobile finance, or popular enterprise finance, there are numerous options to maintain your enterprise going for walks smoothly.

If you are prepared to take manipulate of your cash float, discover these bill financing businesses nowadays and secure the investment your enterprise needs!